What Does “Contingent” Mean in Real Estate?

If you’ve been house hunting in East Texas—or thinking about selling—you’ve probably seen the word contingent pop up on a listing and thought, “Okay…but what does that actually mean???”

You’re not alone. Contingencies are one of the most misunderstood parts of a real estate contract, and they’re rarely explained in plain English. I’m here to change that! Let’s break down what it means when a home is marked “contingent” in the MLS, Zillow, or Realtor.com, what types of contingencies exist, and (most importantly!) how they affect you as a buyer or seller in today’s East Texas real estate market.

So, what does “contingent” mean?

In real estate, a contingent property means the seller has accepted an offer, but the sale depends on certain conditions being met before it can officially close. In other words, the home is spoken for, but not sold yet.

If those conditions (called contingencies) aren’t satisfied within a specific, agreed upon timeframe, the contract can fall apart—and the home may return to active status. I’m going to walk us through the most common contingencies you’ll see in our East Texas market!

1. Contingent Upon the Sale of Another Property

This is the one I get asked about most. This contingency means the buyer must sell their current home before they can purchase the new one as they will need the proceeds from their current home in order to purchase the new one. Their financing—and sometimes their peace of mind—depends on it. What this means for sellers:

You’re under contract, but there’s an extra layer of uncertainty and risk.

The timeline can be longer. A normal financing contingency may take 30-40 days, whereas this contingency can take, on average, anywhere from 60-90 days! Sometimes longer. There are many factors that determine the number of days. Even then, it’s not uncommon for the closing date to get extended due to the buyer’s home not selling. The timeline depends on whether or not the buyer’s home is on the market yet or not (this happens when buyers can only move if they find their next house), whether the home is already under contract (this moves things along quicker and shortens the timeline), and whether or not the buyers are proactively working to get their home under contract (i.e. are they getting showings, lowering the price, and aggressively approaching the market).

If the buyer’s home doesn’t sell, the deal may fall through.

Let’s pretend you’re a seller and you receive an offer on your property that is contingent upon the sale of the buyer’s home. What happens if you accept their offer and go under contract, but then another buyer comes along wanting to make an offer!

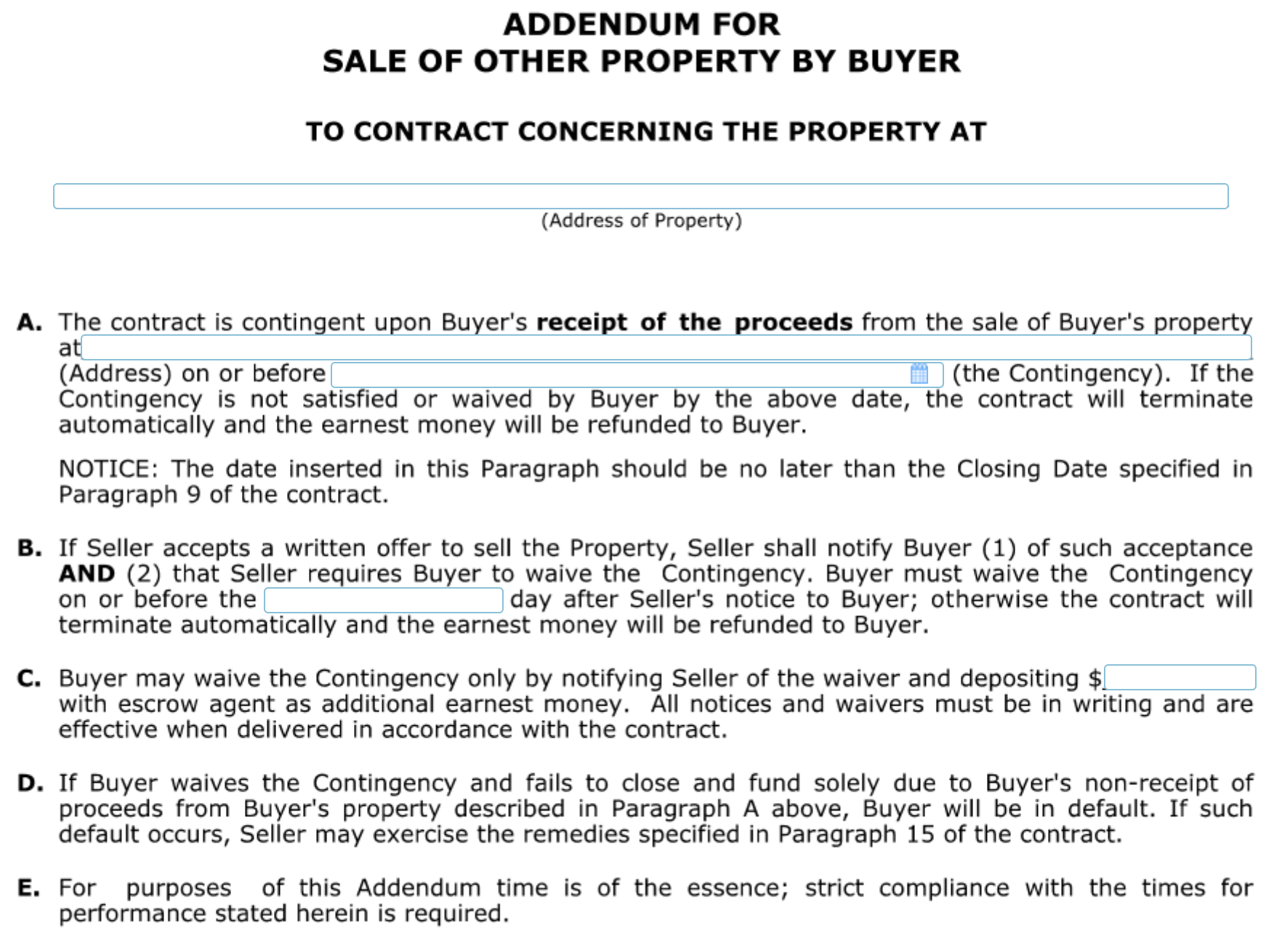

You can choose to accept their offer, but under the Addendum for Sale of Other Property by Buyer, you are obligated to notify the buyers of this accepted offer immediately. Depending on the number of agreed upon days, the buyers would then have x days (typically 3-5) to either WAIVE THEIR CONTINGENCY or the contract AUTOMATICALLY TERMINATES.

As a side note, while there are certainly exceptions, most buyers are not able to buy their next home without needing to sell their current home first.

If the buyer is not able to waive their contingency (this is their way of saying “We will still buy the house without having to sell our current home first.”

This is why pricing, condition, and strategy matter so much when listing—especially if your buyer has a home to sell. Below is what the Addendum for Sale of Other Property by Buyer looks like:

2. Financing Contingency

The Third Party Financing Addendum is a contingency protects the buyer if their loan is not approved. Even with a pre-approval, financing is not guaranteed until the lender finishes the entire underwriting process. Again, it’s not over until it’s over! A buyer has to get the CLEAR TO CLOSE! Until a lender issues the clear to close (typically 3 days prior to the PROPOSED closing date), anything can happen…and I mean ANYTHING!

Things that can derail financing include:

a low appraisal

changes in debt-to-income ratio

job or income changes

credit issues

undisclosed debts

If financing falls through within the contingency period, the buyer can typically terminate the contract without penalty. From a seller’s perspective, this contingency is standard—but it’s also where the strength of an offer really shows. Not all financing contingencies are equal, though. A strong financing contingency usually includes:

a reputable, responsive lender (local lenders often make a big difference here)

a true pre-approval, not just a pre-qualification

reasonable timelines for approval

clean documentation from the buyer

3. Appraisal Contingency

The appraisal contingency protects the buyer if the home does not appraise for the agreed-upon purchase price.

Here’s the part many people don’t realize—the appraiser works for the lender, not the buyer or the seller. Their job is to determine the market value of the property based on recent comparable sales—not emotions, bidding wars, or how badly someone wants the house.

Low appraisals can happen for several reasons, especially in East Texas:

rapid price increases without recent comparable sales

unique or rural properties with limited comps

multiple-offer situations that push prices upward quickly

market shifts where values begin to stabilize or soften

When an appraisal comes in low, the lender will only lend based on the appraised value, not the contract price. At that point, buyers and sellers have several options:

renegotiate the purchase price to match the appraisal

split the difference between appraised value and contract price

the buyer brings additional cash to closing

the buyer terminates the contract under the appraisal contingency

None of these options are automatic—it all comes down to negotiation, leverage, and the strength of the contract.

A low appraisal doesn’t automatically mean your home is overpriced. It often means:

the market moved faster than the data

there weren’t enough comparable sales

the property is truly unique

However, appraisal issues can cause delays, renegotiations, or termination if expectations aren’t aligned. This is why pricing strategy on the front end matters so much—especially in markets that are shifting or stabilizing.

Final Thoughts

Contingencies aren’t bad—they’re tools—but how they’re written, negotiated, and timed can absolutely make or break a deal.

In competitive East Texas markets, the strength of the contract often matters just as much as the price. Clean terms, realistic timelines, and proactive communication are what keep deals together. Whether you’re buying or selling in White Oak, Tyler, Longview, Gilmer, Hawkins, or anywhere across East Texas, contingencies directly affect:

how long a home stays under contract

how secure the deal really is

whether backup offers make sense

how much leverage each party has

Understanding these details allows you to make confident, informed decisions—not emotional ones. If you ever see the word contingent and feel unsure, that’s your sign to ask questions. Real estate should never feel confusing or rushed. My job is to help you understand what’s happening before it becomes a problem—and to guide you through the parts most people don’t talk about.

If you’re buying, selling, or just curious about how contingencies could affect your situation in the East Texas real estate market, I’m always happy to help. Reach out anytime to talk through your options, timing, and goals—no pressure, just clarity.

CLICK HERE TO GET A FREE HOME VALUE REPORT.

I don’t just list properties…I SELL THEM! #getlistinwithkristin

Kristin Koonce, REALTOR®

(903)241-2608

kristinkoonce@gmail.com

www.kristinkoonce.com

BOLD Real Estate Group, Suzanne Smith, Broker/Owner